The world has witnessed the inexorable rise of DeFi decentralized finance from 2020. The trend tends to be increasingly strong and drives a lot of new business to come into being. Seeing from the data of loan, money management, and exchanges of Defi programs, Defi satisfies the real needs of many investors, which makes the data keep rising on the chain. At present, the amount of total lockups of Defi has surmounted 100 billion USD across the world.

That is because the Defi has sprouted in the market of blockchain, the birth of Defi makes it possible for investors to experience the appeal of decentralized financial service. Whether it is a loan, insurance, or money management, it is executed via the code on the chain or the pre-set rules automatically and without facing the risks of black casework of brokers. On the one hand, the investors tend to be more at ease for their fund is hold by them; on the other hand, the use of funds is increased and they have more choices when choosing and matching their investment strategy.

At present, various kinds of Defi emerge endlessly. However, a one-stop Defi product that can satisfy all kinds of needs is still absent in the market. In this context, Rabbit Finance comes into being.

What is Rabbit Finance?

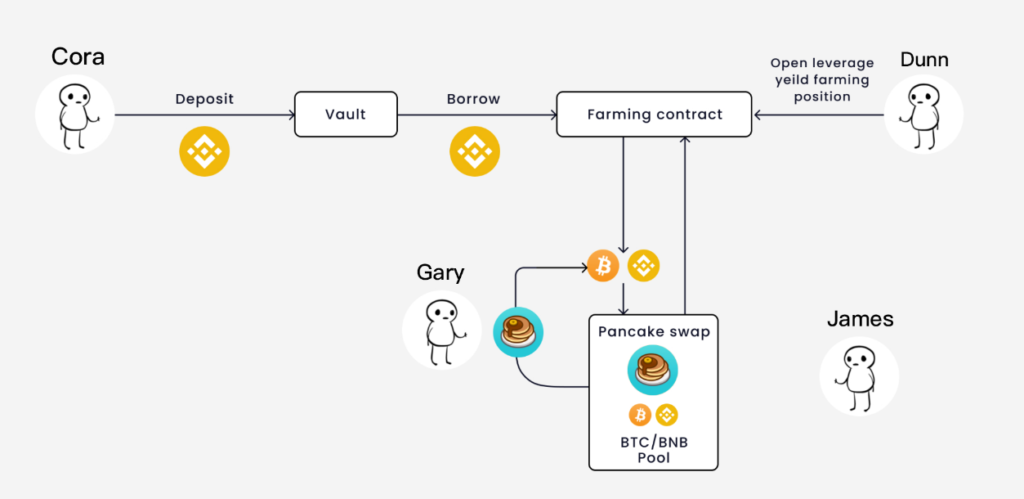

Rabbit Finance is a leveraged yield farming protocol based Binance Smart Chain (BSC) released by Rabbit Finance Lab. It supports users participating in liquidity farming through over-lending plus leverage to get more revenue.

When the user has insufficient funds but wants to participate in DeFi liquidity farming, Rabbit Finance can provide up to 10X the leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

As predecessors of this area like Link, COMP, and BAL are fighting alone, Rabbit Finance, a latecomer, has started to propel resource integration to be the one for all of Defi.

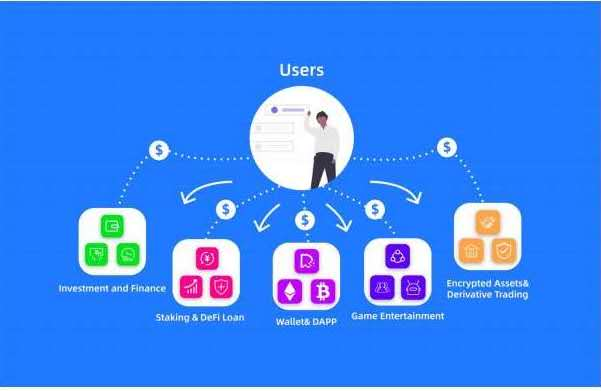

Defi ecology, on the Rabbit Finance, ambitiously included modules like lever gun pool + arithmetic stablecoin, NFT+ arithmetic stablecoin. For Rabbit Finance, they hope to build the Defi ecology through the easy to more advanced and Interlocking combination of functions.

It makes it possible for users to experience the various context of the use of DeFi in a one-stop way, as well as yielding rich returns.

The feature and value of Rabbit Finance

Rabbit Finance provides lever gun pool arithmetic and can support up to 10X the leverage, which means the return of the earnings of the users can be inflated tenfold.

Figuratively speaking, if you are mining in a CAKE/BNB pool, maybe you have your liquid token worth 1,0000 RMB mining in the pool, and the revenue there is 100%. However, via Rabbit, you can borrow extra asset mining in the pool to get 1000% annualized returns(the interests and costs were taken out), this is the most direct way to maximize the revenue.

Of course, same as other levers, if the price trend is at a disadvantage, the risk of clear existing. Even so, you can still borrow USD or BNB from a much safer pool of money and get reasonable annualized returns under lower risks.

On Strategy, Rabbit Finance adds to the mechanism of reinvestment to maximize the users’ earnings. The bounty hunter can act reinvestment at any time and then converts them into the LP tokens for the pool you are farming and compounds them onto your farming principal so you can maximize your APY.

Besides, when the bounty hunter pitches on the pool and executes the reinvestment, 30% of the bounty of the pool is used as buyback funds to promote the value of the token.

Why does reinvestment raise the value of the token? This can be explained by the supply and demand relationship in economics. When the demand exceeding the supply, the value of the asset is bound to raise. According to the deflation mechanism of Rabbit Finance, the 30% of reinvestment earnings is used to repurchase fund to realize the continuous deflation of the token. In the author’ perspective, the deflation mechanism of Rabbit will become the vital factor for realizing the price of token. Continuous buyback and dispose make it possible for the volume of token supply to decline on a limited scale. These will drive the token to be increasingly precious. When Rabbit achieves its implementation, the price of the token is expected to rise correspondingly.

The 30% of the bounty of the pool is used as buyback funds to promote the value of the token. For this service, 0.4% of the bounty pool is directly given to the bounty hunter as a reward, the remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns. The huge power gifted by repeated investment makes it possible for investors to make more profits.

Except for the value increase driven by the token deflation, Rabbit has some other values. For example, before Rabbit coming into being, gun pool tokens can do nothing but to govern. However, Rabbit holders can mortgage their stakes to the board to share bonuses. As long as Rabbit Finance is profitable, its holders are given the right to share the bonus as shareholders and make easy money.

NFT (Non-fungible Token) is an emerging niche market for nearly everyone to take his chance. It is predicted by the specialist that NFT has its potential to become one of the world’s biggest market. The authority of the Rabbit has given much thought to its token. Rabbit Finance Lab will continuously empower Rabbit token, for example, Rabbit holders can snap up irregular issued NFT artwork, and the Rabbit will be automatically locked up during this period. Its circulation will be blocked and its value is expected to be pulled up in a short term. Holding NFT can accelerate mining, empowering the NFT with value with the help of Rabbit.

These two parties are of reciprocal relationships, that is to say, holding Rabbit makes it possible for holders hold NFT, the appreciation of NFT token reacts on the appreciation of Rabbit.

Words in the End

From ordinary investors’ perspective, there are high entry barriers to use traditional finance—it’s hard for borrowers to raise a loan, while the providers get low earnings. Rabbit is expected to solve this problem under the context of Defi to give its users high earnings as well as increasing the liquidity of the fund. This is just one kind of benefit and change made by Rabbit Finance to investors. In the future finance world, Rabbit Finance will play a bigger constructive role.

Disclaimer

This article does not contain any investment advice. Investment always involves risk, be careful with every decision.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Open Headline journalist was involved in the writing and production of this article.